A bill that will permanently allow for remote reverse mortgage counseling via telephone or video conferencing services in the state of Massachusetts has been signed into law by Gov. Maura Healey (D), doing away with a strict face-to-face requirement that has stretched the state’s counseling resources and, at times, halted reverse mortgage business within the state.

The face-to-face requirement had been active within Massachusetts since 2010, but recent challenges — most especially those posed by the COVID-19 pandemic — exposed how a restriction initially meant to protect seniors actually created serious challenges for them. This is due to only a handful of U.S. Department of Housing and Urban Development (HUD)-approved reverse mortgage counselors being active in the state, among other issues.

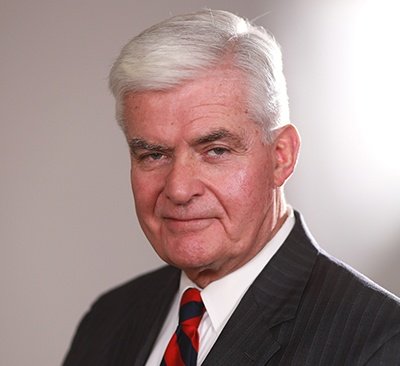

RMD sat down with two of the key reverse mortgage industry figures that have worked for years to get to this point — George Downey and Brett Kirkpatrick of The Federal Savings Bank in Braintree, Mass. — to get a better understanding of what led to this moment.

Good intentions and challenging outcomes

Downey explained the dynamics of the situation, saying that while the original law creating the face-to-face requirement was well intentioned, it exacerbated the challenges of not just conducting business but meeting the needs of seniors seeking a reverse mortgage.

“Stepping back and looking at it from a distance, I think this is a good example of how perception and misinformation collide, especially in creating legislation,” he said. “It’s difficult to right the ship; changing legislation is a very difficult thing to do, as we’ve found out. This is particularly true with reverse mortgages and the reputational issues that have dogged the program for so long.”

While the challenges proved difficult to manage, particularly when the pandemic collided with the face-to-face requirement that effectively halted business in the state, lobbying of legislators to provide education and clarity on the issues helped to push this new law to become reality.

“I think as the public has become more broadly aware of [the challenges] … people are more aware of what they’re all about, so they are more inclined to [understand them],” Downey said.

Downey and Kirkpatrick served for years as the “front-line soldiers” on the ground as the state attempted to get to this point. But Downey is quick to point out the assistance gained from both the Massachusetts Mortgage Bankers Association (MMBA) as well as the National Reverse Mortgage Lenders Association (NRMLA) in getting the final bill over the finish line.

“They led the charge on this and brought a lot of credibility to the argument,” Downey said. “Brett and I have been involved from the beginning. We were the foot soldiers on this whole thing, but thank goodness, we finally have it resolved. And this is a permanent solution, at least until the next time something happens.”

Passage of the bill

Waivers and exceptions to the in-person counseling rule have generally persisted since the onset of the pandemic, but proposed permanent solutions since that point had always fallen short and the state Legislature instead opted for temporary reauthorizations of the exceptions.

At the beginning of April 2024, however, the final extension waiving the in-person counseling rule expired. It remained to be seen whether or not a permanent solution would proceed or if another temporary extension would be granted.

Rep. Kate Lipper-Garabedian (D) led the charge in the Massachusetts House of Representatives, assuming the baton on the issue from her predecessor, Paul Brodeur, a former state representative and current mayor of Melrose, Massachusetts. Ultimately, language from a version of the bill Lipper-Garabedian introduced was attached to a wider supplemental budget bill, which went on to pass both chambers of the state Legislature before being signed into law by Healey.

Looking ahead

When reached by RMD, Rep. Lipper-Garabedian said she was happy that issues specific to seniors were being addressed by the bill’s passage.

“I am thrilled that a policy I have championed since taking office is now the law in Massachusetts,” Rep. Lipper-Garabedian told RMD in an email. “As House Vice Chair of Elder Affairs, I am particularly mindful of the importance of enabling older adults to navigate their lives safely and with agency. With passage of this legislation, Massachusetts joins the other 49 states in empowering older adults to participate in reverse mortgage counseling virtually and by phone, in addition to the in-person option.”

The effective date of the new law is also retroactive to March 31, 2024, meaning that it technically took effect the day before the final waiver’s expiration, despite only passing this week.

When asked what he primarily takes away from the ordeal, Kirkpatrick says it’s about collaboration and a series of best practices.

“I think the lesson is that legislative change and legislative work are very much a ground game and an inside game, and we had some great mentors that helped us get in front of the right people,” he said. “They get bombarded with emails and [many correspondences], but you really have to get to the right person at the right time and just make a very simple case.”

In an email update to its membership, NRMLA President Steve Irwin credited the work of Downey and Kirkpatrick for the ultimate outcome, calling this instance an example of the way association members can impact local reverse mortgage policy.